Palau Chamber Of Commerce - Truths

Table of ContentsThings about Palau Chamber Of CommerceAn Unbiased View of Palau Chamber Of Commerce8 Easy Facts About Palau Chamber Of Commerce ShownGetting My Palau Chamber Of Commerce To Work6 Simple Techniques For Palau Chamber Of CommerceThe Palau Chamber Of Commerce Diaries

While it is safe to state that a lot of charitable organizations are honorable, organizations can definitely struggle with several of the very same corruption that exists in the for-profit business globe. The Article located that, in between 2008 as well as 2012, greater than 1,000 nonprofit organizations examined a box on their IRS Type 990, the tax return form for exempt companies, that they had experienced a "diversion" of assets, implying embezzlement or various other fraud.4 million from acquisitions connected to a sham organization started by a previous assistant vice president at the organization. An additional instance is Georgetown University, who suffered a substantial loss by an administrator that paid himself $390,000 in additional compensation from a secret savings account previously unknown to the university. According to government auditors, these tales are all as well usual, and act as sign of things to come for those that seek to develop and run a charitable organization.

In the case of the HMOs, while their "promo of wellness for the advantage of the community" was regarded a philanthropic function, the court determined they did not run mostly to benefit the neighborhood by giving health services "plus" something additional to benefit the neighborhood. Therefore, the revocation of their excluded condition was maintained.

The 2-Minute Rule for Palau Chamber Of Commerce

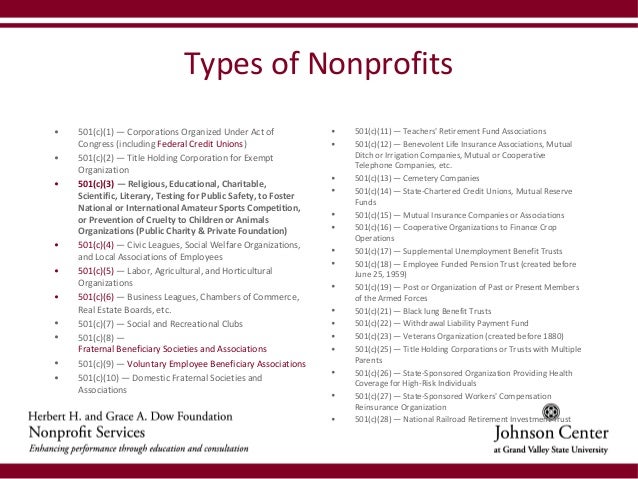

By contrast, 501(c)( 10) organizations do not attend to payment of insurance policy advantages to its participants, as well as so might prepare with an insurer to offer optional insurance without endangering its tax-exempt status.Credit unions as well as various other shared monetary organizations are identified under 501(c)( 14) of the IRS code, as well as, as part of the banking sector, are greatly regulated.

Other credit rating unions and not-for-profit monetary organizations are covered by 501(c)( 14 ). In our next module, we will look at the needs and steps for including as a nonprofit.

Excitement About Palau Chamber Of Commerce

Each classification has their very own needs and also compliances. Below are the types of nonprofit classifications to help you choose which is best for your company. What is a nonprofit?

Provides settlement or insurance policy to their members upon health issues or various other stressful life occasions. Subscription must be within the same workplace or union. Use subscription as a result of support outside causes without settlement to members. Establish and also handle educators' retired life funds.: Exist solely to aid in the interment process for members.

g., online), also if the nonprofit does not straight solicit contributions from that state. Furthermore, the internal revenue service calls for disclosure of all states in which a nonprofit is signed up on Type 990 if the nonprofit has income of even more than $25,000 each year. Penalties for failure to register can consist of being forced to provide back donations or encountering criminal fees.

Palau Chamber Of Commerce Things To Know Before You Buy

com can help you in registering in those states in which you mean to get donations. A not-for-profit company that obtains substantial parts of its revenue either from governmental resources or from straight payments from the public might qualify as a publicly supported organization under section 509(a) of the Internal Earnings Code.

A not-for-profit firm with business locations in several states might create in a single state, then sign up to do company in other states. This indicates that not-for-profit corporations have to officially sign up, submit yearly reports, as well as pay yearly costs in every state in which they carry out organization. State laws require all not-for-profit firms to keep a registered address with the Assistant of State in each state my response where they do organization.

Fascination About Palau Chamber Of Commerce

A Registered Representative receives and forwards crucial legal files as well as state document in behalf of the company. All firms are normally needed to submit annual reports and pay franchise costs to the state in which they're integrated; nonetheless, nonprofits are often exempt from paying franchise business fees. In enhancement, nonprofits are usually required to each year renew their enrollment in any kind of state in which they are signed up.

For example, section 501(c)( 3) charitable organizations may not intervene in political projects or carry out substantial lobbying activities. Get in touch with an attorney for even more details information regarding your company. Some states only need one director, however most of states need a minimum of 3 supervisors.

A business that serves some public objective as well as therefore delights in unique treatment under the legislation. Not-for-profit companies, click resources as opposed to their name, can earn a profit yet can not be created largely for profit-making. When it pertains to your company framework, have you thought of arranging your venture as a not-for-profit corporation? Unlike a for-profit service, a not-for-profit may be qualified for specific advantages, such as sales, home and also income tax obligation exceptions at the state level.

What Does Palau Chamber Of Commerce Mean?

Another significant difference between a profit and not-for-profit transaction with the therapy of the profits. With a for-profit service, the owners and investors usually obtain the profits. With a nonprofit, any kind of money that's left after the company has actually paid its bills is returned into the company. Some kinds of nonprofits can obtain contributions that are tax obligation deductible to the individual that contributes to the company.